The Single Strategy To Use For Wealth Management

Wiki Article

An Unbiased View of Wealth Management

Table of Contents7 Simple Techniques For Wealth ManagementThe Greatest Guide To Wealth Management4 Simple Techniques For Wealth ManagementThe 5-Minute Rule for Wealth ManagementThe Best Guide To Wealth Management

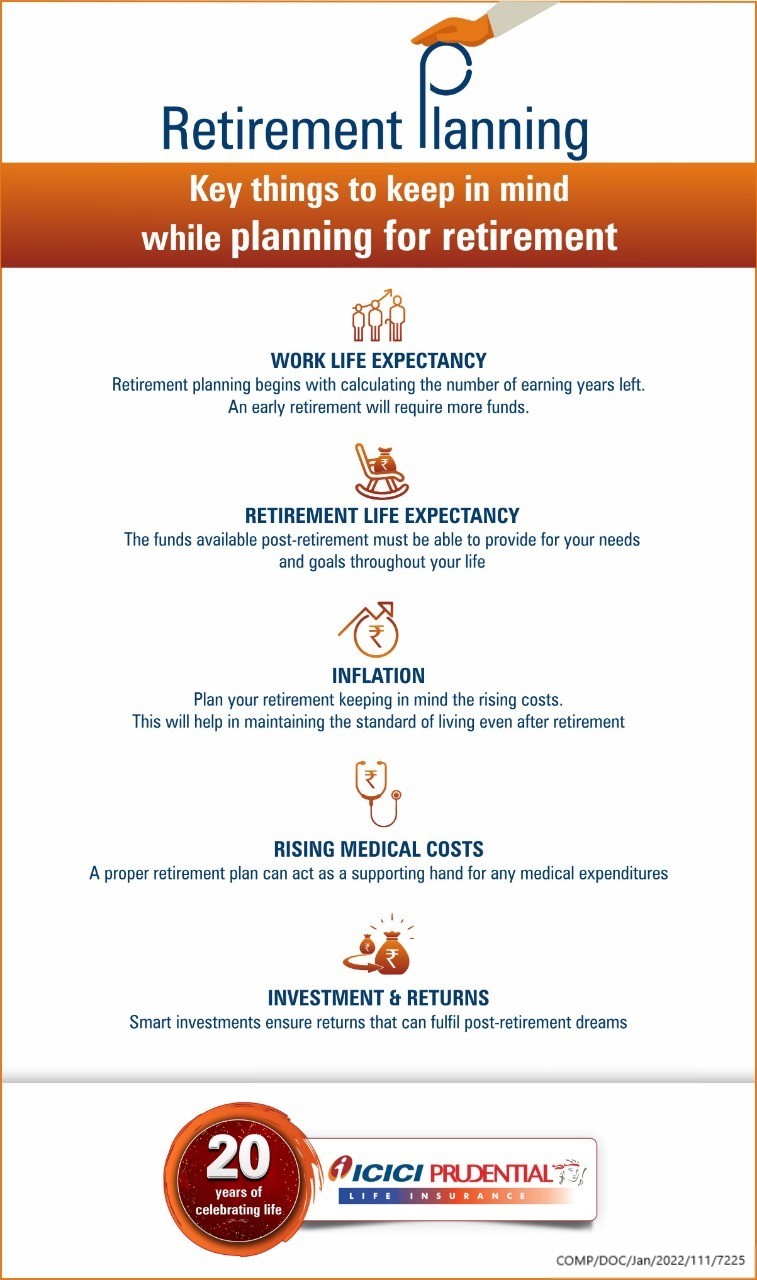

You want to guarantee that your family could survive monetarily without drawing from retired life savings should something take place to you. As you age, your investment accounts ought to become much more conventional - wealth management. While time is going out to conserve for people at this phase of retired life preparation, there are a few benefits.And also it's never also late to set up as well as contribute to a 401( k) or an IRA. One advantage of this retirement preparation stage is catch-up contributions.

, which will assist cover the costs of a nursing house or house treatment ought to you need it in your advanced years. If you don't correctly plan for health-related costs, especially unanticipated ones, they can annihilate your cost savings.

The Ultimate Guide To Wealth Management

It takes into account your complete monetary image. For many Americans, the single greatest property they possess is their residence. How does that fit right into your retired life strategy? A residence was taken into consideration a property in the past, but because the housing market collision, organizers see it as much less of a possession than they when did.

There may also be adjustments coming down the pipeline in Congress relating to inheritance tax, as the inheritance tax amount is arranged to drop to $5 million in 2026. Once you get to retired life age and also begin taking circulations, taxes become a big trouble. Many of your retirement accounts are taxed as common earnings tax.

How Wealth Management can Save You Time, Stress, and Money.

Age features raised medical expenditures, and you will certainly have to browse the often-complicated Medicare system. Many individuals really feel that typical Medicare does not give ample protection, so they seek to a Medicare Benefit or Medigap plan to supplement it. There's likewise life insurance policy and also long-term treatment insurance policy to think about. An additional kind of plan issued by an insurance provider is an annuity.

You this page placed money on down payment with an insurance provider that later pays you an established monthly quantity. There are various choices with annuities as well as numerous factors to consider when deciding if an annuity is appropriate for you. Retirement preparation isn't hard. It's as very easy as setting aside some cash every monthevery little bit matters.

That's due to the fact that your financial investments expand over time by earning rate of interest. Retired life planning enables you to sock away enough cash to maintain the very same way of living you presently have.

That's where retired life preparation comes right into play. As well as it does not matter at which point you are in your life.

How Wealth Management can Save You Time, Stress, and Money.

We have actually developed a detailed guide that can assist you prepare your retired life. Lots of financial investment alternatives can aid you conserve for retired life. We understand that growing your money safely is essential.When spending your cash, make sure that you conserve appropriately for any her latest blog kind of unanticipated monetary requirements. Life insurance policy can secure your liked ones with a safety financial protection in your lack.

When preparing for the future, try to choose various sorts of financial investment choices that put your money in differing asset courses, industries, as well as industries. By doing this, if you experience a loss in one investment or if one option does not execute per your expectations, you can rely upon the others.

For circumstances, if you wish to settle in a brand-new city, your month-to-month expenses useful content might be higher, relying on the city. Likewise, if you like to travel, you might invest much more on traveling expenses in retired life than somebody that prefers being at residence. Your wants can assist you pick a suitable strategy that can generate adequate returns.

The 8-Second Trick For Wealth Management

However, these can vary depending on the strategy you choose. Retirement plans normally enable you to select the costs you intend to pay towards your plan, as per your demands. A greater premium may result in a higher earnings throughout your retirement. The vesting age is the age at which you can start receiving your pension plan or income from the plan.Report this wiki page